Introduction

In recent years, the concept of financial independence and early retirement, or the FIRE movement, has captured the imagination of individuals worldwide. The goal of FIRE is simple: save, invest, and structure your life in such a way that you can retire decades before the traditional retirement age. But the path to early retirement requires dedication, strategy, and a deep understanding of financial planning. In this article, we’ll dive into the various types of FIRE, strategies for achieving it, and the potential risks and benefits of pursuing financial freedom early.

What is the FIRE Movement?

The FIRE movement started as a grassroots effort, popularized by blogs, books, and forums. Inspired by books like Your Money or Your Life by Vicki Robin and Joe Dominguez, FIRE followers aim to control their finances so they can live free from the pressures of a traditional career. For some, FIRE is about cutting down expenses to save aggressively; for others, it’s about achieving a lifestyle supported entirely by investments or passive income.

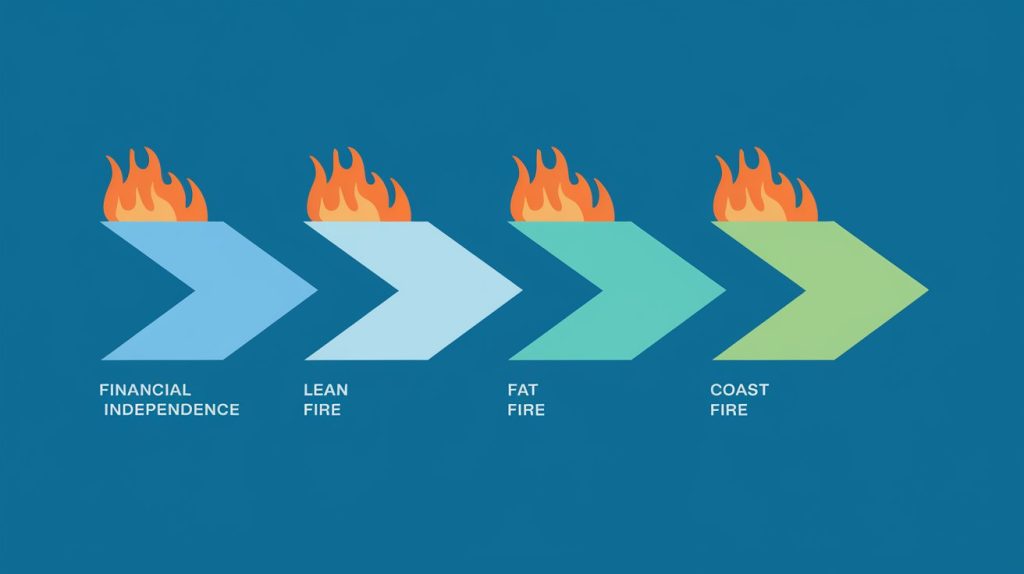

Within FIRE, there are a few major subcategories:

- Lean FIRE: For those who can live on a very low budget. Lean FIRE is typically aimed at minimalists willing to drastically reduce expenses to achieve financial freedom sooner.

- Fat FIRE: This approach is for individuals who want to achieve financial independence without sacrificing a higher lifestyle. Fat FIRE often requires a much larger investment portfolio.

- Coast FIRE: In this version, individuals save aggressively in the early years, then rely on compound interest to “coast” to retirement without additional contributions later on.

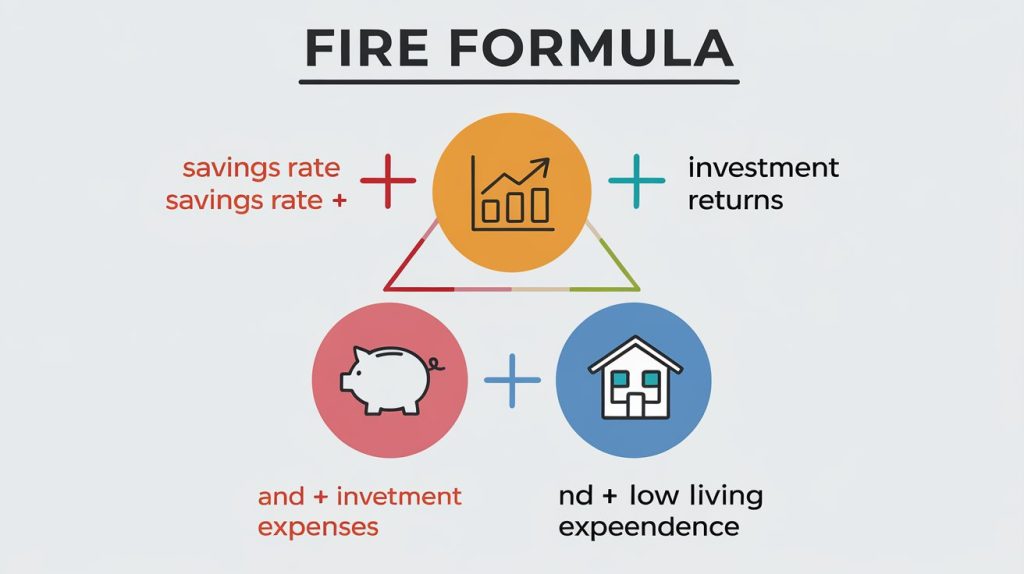

The FIRE Formula

The basic formula for FIRE involves three key elements: savings rate, investment returns, and low living expenses. The goal is to build up enough investments to generate a passive income stream that covers all necessary expenses, allowing for a self-sustaining lifestyle.

1. Savings Rate

The savings rate is crucial to FIRE. Most FIRE enthusiasts aim to save 50% or more of their income, though percentages vary. Increasing the savings rate often involves reducing discretionary spending, rethinking housing, transportation, and even food costs. Many FIRE followers use a budgeting tool or spreadsheet to track expenses.

2. Investment Returns

The primary vehicle for FIRE is usually stock market investments, often through low-cost index funds. Many use the “4% Rule,” which suggests you can withdraw 4% of your portfolio annually in retirement without depleting it over a typical lifespan.

3. Low Living Expenses

FIRE success depends on maintaining a lifestyle that can be sustained within the passive income limit. Lowering living expenses enables individuals to save more and reduces the amount of income required in retirement.

Strategies for Achieving FIRE

Achieving FIRE isn’t a one-size-fits-all approach, but it involves a few core strategies that anyone can adapt to suit their situation.

1. Reduce Expenses

Cutting down on expenses is usually the first step in a FIRE journey. This might mean downsizing a home, buying a used car, or even living without a car altogether. It also includes reducing recurring costs, such as subscriptions or dining out, and finding budget-friendly alternatives for necessary items.

2. Increase Income

Higher income allows for higher savings. Many FIRE seekers look for ways to increase income through side hustles, freelancing, or advancing in their primary careers. Others build additional revenue streams through rental properties or dividend-paying stocks.

3. Invest Wisely

FIRE enthusiasts generally invest in a mix of stock market index funds, real estate, and, for some, small business ventures. The goal is to grow the investment portfolio enough to cover all living expenses in retirement.

4. Track and Adjust

Staying on the FIRE path requires constant tracking and adjustment. Many use financial tracking apps or budgeting spreadsheets to ensure they’re hitting their savings and investment targets.

The Risks and Downsides of FIRE

While the idea of retiring early is appealing, it’s essential to understand the risks involved. Here are some considerations to keep in mind:

- Market Volatility: FIRE heavily relies on investments, primarily in stocks. If markets perform poorly, retirement funds might not last as long as anticipated.

- Healthcare Costs: In early retirement, healthcare costs can be a major burden, especially if health insurance isn’t available through an employer.

- Burnout from Saving: High savings rates can lead to burnout, especially when the savings goals require lifestyle sacrifices that may feel overly restrictive.

- Social Isolation: Early retirees often find themselves without a network, as friends and family may still be working.

Is FIRE Right for You?

The FIRE movement isn’t for everyone. While some embrace the minimalist lifestyle and stringent savings, others may find it too restrictive. Additionally, your career path, family situation, and personal goals all play a role in whether pursuing FIRE makes sense. For some, a hybrid approach—where financial independence is pursued without a strict retirement date—may offer a comfortable balance.

If you’re intrigued by FIRE, start by assessing your financial situation, setting clear goals, and trying out some FIRE strategies on a smaller scale to see if they align with your lifestyle.

Conclusion

The FIRE movement can offer an exciting path to freedom, control, and fulfillment outside the bounds of traditional work life. But as with any major life decision, it requires careful planning, commitment, and self-awareness. Whether you’re pursuing Lean FIRE, Fat FIRE, or simply aiming to reach financial independence, the journey can empower you to live life on your terms, providing a financial foundation for whatever dreams you decide to pursue next.

You can also read Start Early, Retire Happy: Building Wealth in Your 20s, 30s, and Beyond