Credit scores play a critical role in determining financial well-being. Whether you’re buying a car, applying for a loan, renting an apartment, or even getting a job, your credit score could influence the outcome. Understanding what makes up your credit score and how to improve it can help you better manage your finances and access more favorable terms for credit.

What is a Credit Score?

A credit score is a three-digit number that represents your creditworthiness. It’s used by lenders to assess how likely you are to repay borrowed money. Scores typically range from 300 to 850, with higher scores indicating a lower risk for lenders.

Credit scores are calculated using a variety of factors, primarily from your credit report, and are generated by credit bureaus such as Equifax, TransUnion, and Experian. The most commonly used credit score model is the FICO score.

What Factors Affect Your Credit Score?

Understanding what factors impact your credit score can help you know where to focus your efforts to improve it. The main factors include:

- Payment History (35%)

Your payment history is the most significant factor. Lenders want to know whether you’ve paid past credit accounts on time. Even one late payment can negatively affect your score. Tip: Set up reminders or automatic payments to ensure you’re never late on a bill. - Credit Utilization (30%)

Credit utilization refers to the amount of available credit you are using. Keeping this ratio low is critical. Ideally, you should aim to use less than 30% of your available credit. Tip: Pay off credit card balances in full or make multiple payments throughout the month to keep your utilization low. - Length of Credit History (15%)

A longer credit history can boost your score because it gives lenders more data to evaluate your borrowing habits. However, even if you’re a new borrower, you can build a good score by making consistent, on-time payments. Tip: Keep older accounts open, even if you no longer use them, as closing them can shorten your credit history. - Credit Mix (10%)

Lenders like to see that you can manage a variety of credit types, such as installment loans (car loans, student loans) and revolving credit (credit cards). Tip: If you only have credit cards, consider diversifying your credit profile with a small loan, such as a credit-builder loan. - New Credit (10%)

Applying for new credit too frequently can be a red flag to lenders. Each time you apply for credit, a “hard inquiry” is added to your credit report, which can lower your score temporarily. Tip: Be strategic about when you apply for new credit to avoid unnecessary hard inquiries.

How to Check Your Credit Score

You are entitled to a free copy of your credit report from each of the three major credit bureaus once a year through AnnualCreditReport.com. Monitoring your credit regularly ensures that you can spot errors and fraud early.

Many banks, credit unions, and credit card issuers also offer free credit score monitoring tools. Keeping track of your score can help you understand how your financial habits affect your creditworthiness.

Common Credit Score Myths

It’s easy to get confused with so much information (and misinformation) out there about credit scores. Here are some common myths debunked:

- Myth 1: Checking your credit score lowers it

Checking your own credit score is considered a “soft inquiry,” which does not affect your score. Only hard inquiries from lenders can have a slight, temporary effect. - Myth 2: Closing credit card accounts improves your score

While closing accounts might seem like a good way to simplify your finances, it can hurt your score by decreasing your available credit and shortening your credit history. - Myth 3: Carrying a balance helps your score

There’s no need to carry a balance month-to-month. Paying off your balances in full is better for both your score and your wallet. - Myth 4: You have one universal credit score

You have multiple credit scores because there are different models used by lenders and credit bureaus. Your score may vary slightly depending on where it’s pulled from.

How to Improve Your Credit Score

Improving your credit score takes time, but following a few key strategies can help:

- Pay Bills on Time

Set reminders or automatic payments to ensure you never miss a due date. Even one missed payment can have a lasting impact on your score. - Reduce Credit Card Balances

Aim to pay off your credit cards each month. If that’s not possible, reduce the balance to keep your credit utilization ratio below 30%. - Keep Old Accounts Open

Don’t close old accounts unless absolutely necessary. They help extend the length of your credit history, which can positively impact your score. - Limit New Credit Applications

Avoid applying for new credit frequently. Too many inquiries in a short time frame can lower your score. - Dispute Errors on Your Credit Report

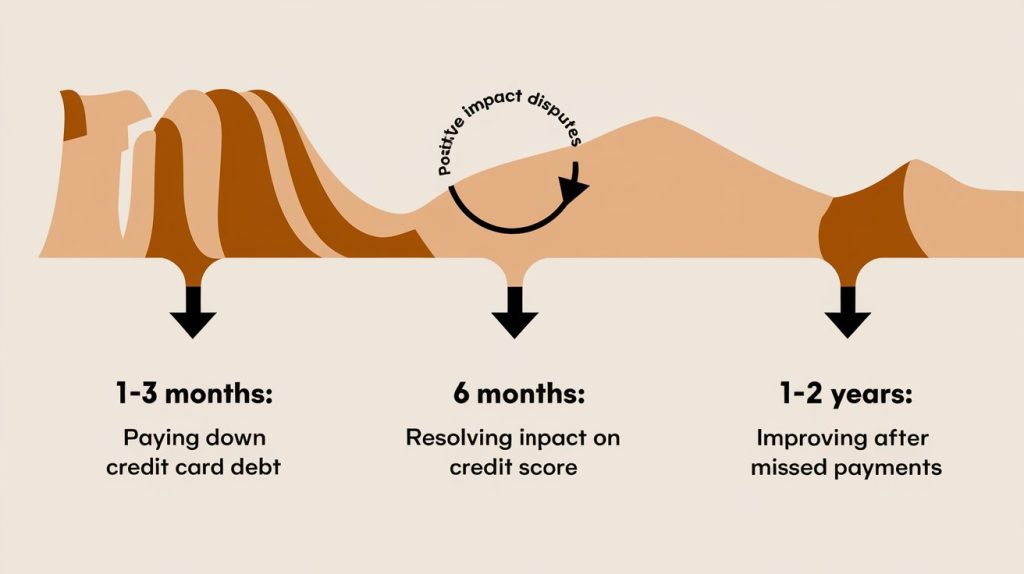

Mistakes on your credit report, such as incorrect account balances or late payments that never occurred, can bring down your score. Regularly check your report for errors and dispute them with the credit bureaus if necessary.

How Long Does it Take to Improve Your Credit Score?

There’s no quick fix for improving your credit score, but consistency is key. Small changes, like paying off credit card debt, can have a noticeable effect in a few months. Major issues, like missed payments or defaults, may take years to fully resolve. However, the good news is that the impact of negative marks on your report lessens over time, especially with good financial habits in place.

Final Thoughts: Be Patient and Persistent

Improving your credit score is a long-term process, but it is worth the effort. By understanding how your score is calculated, regularly monitoring your credit, and adopting positive financial habits, you can build and maintain a solid credit score that will open up many financial opportunities.

Whether you’re looking to finance a big purchase, get better terms on a loan, or simply improve your financial standing, knowing how to manage your credit score is a crucial life skill.

You can also read 7 Mistakes to Avoid When Growing Your Business.