Budgeting is more than just tracking your expenses—it’s a powerful tool that allows you to take control of your financial life and align your spending with your goals. Whether you’re saving for a vacation, a down payment on a house, or simply trying to build an emergency fund, creating a budget is the first step toward financial freedom. In this comprehensive guide, we’ll explore everything you need to know about budgeting, how to create one that works for you, and ways to make your money work harder.

Why Budgeting is Important

A budget is essentially a plan for how you’ll spend your money. It helps you prioritize your spending, prevent overspending, and ensure you have enough for the things that matter most. Without a budget, it’s easy to lose track of where your money is going and end up with little or no savings at the end of the month.

Some key reasons to budget include:

- Financial Clarity: Knowing exactly where your money is going provides peace of mind.

- Achieving Goals: A budget helps you save for short-term and long-term financial goals, such as a new car or retirement.

- Reducing Stress: Financial worries are one of the top causes of stress. A clear plan can reduce anxiety around money.

- Debt Management: Budgeting helps you pay off debt faster by allocating funds specifically for that purpose.

Types of Budgeting Methods

Before creating your budget, it’s essential to understand that there are various types of budgeting methods. The key is to pick one that works for you and fits your lifestyle. Here are some popular approaches:

1. Zero-Based Budgeting

This approach requires you to assign every dollar of your income a specific job, so at the end of the month, your income minus expenses equals zero. It’s highly detailed and ensures you’re fully in control of your spending.

2. 50/30/20 Rule

With this method, you allocate 50% of your income toward necessities, 30% toward wants, and 20% toward savings and debt repayment. It’s less precise but provides a flexible framework for those who prefer less detailed tracking.

3. Envelope System

Popularized by personal finance guru Dave Ramsey, the envelope system involves dividing your cash into different categories (e.g., groceries, entertainment) and only spending what’s in each envelope.

4. Pay-Yourself-First Budgeting

This method prioritizes saving first by allocating a portion of your income to savings and investments before paying bills or making discretionary purchases.

5. Value-Based Budgeting

Rather than focusing on specific percentages, this method encourages you to prioritize spending on what you value most. It’s a more personalized approach that helps you align your budget with your life goals.

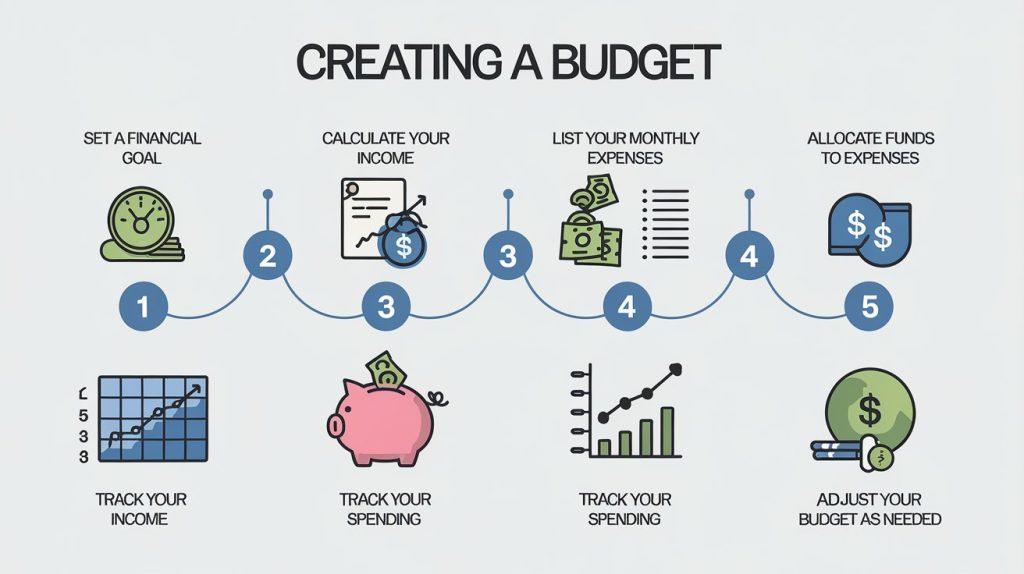

Steps to Creating a Budget That Works

Now that you’re familiar with different budgeting methods, it’s time to create your own budget. Follow these steps for a comprehensive approach.

1. Calculate Your Income

The first step in creating a budget is to know exactly how much money you have coming in each month. This includes your salary, freelance income, and any side hustles. Make sure to account for any taxes or deductions taken from your paychecks.

2. List Your Expenses

Divide your expenses into two categories:

- Fixed Expenses: These are regular costs that don’t change, such as rent or mortgage payments, insurance, and car payments.

- Variable Expenses: These fluctuate from month to month and include things like groceries, utilities, and entertainment.

3. Set Financial Goals

What do you want your money to do for you? Whether it’s building an emergency fund, paying off credit card debt, or saving for a vacation, setting clear goals will help you stay focused and motivated.

4. Allocate Funds

Once you’ve listed your income and expenses, decide how much money you want to allocate toward each expense category. Be realistic and flexible, especially if this is your first time budgeting.

5. Track Your Spending

Keeping track of where your money is actually going is essential to stay on budget. You can do this manually, or use budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital to automate the process.

6. Adjust As Needed

Life is unpredictable, and your budget should reflect that. If you find that you’re consistently overspending in one category, adjust the budget. Remember, a budget is a tool, not a prison.

How to Stick to Your Budget

Creating a budget is one thing, but sticking to it is often the hardest part. Here are some tips to help you stay on track:

1. Automate Your Savings

Set up automatic transfers to a savings account or retirement fund. This ensures you “pay yourself first” and makes it less tempting to spend that money.

2. Use Cash for Discretionary Spending

If you find that swiping your card leads to overspending, try using cash for variable expenses like entertainment and dining out. This method, similar to the envelope system, creates a visual limit to how much you can spend.

3. Review Your Budget Regularly

Life circumstances change, and so should your budget. Make it a habit to review your spending and income each month to ensure your budget is still working for you.

4. Celebrate Small Wins

Reaching a financial milestone, like paying off a debt or hitting a savings goal, is worth celebrating. Treat yourself (within reason) to something small as a reward for staying disciplined.

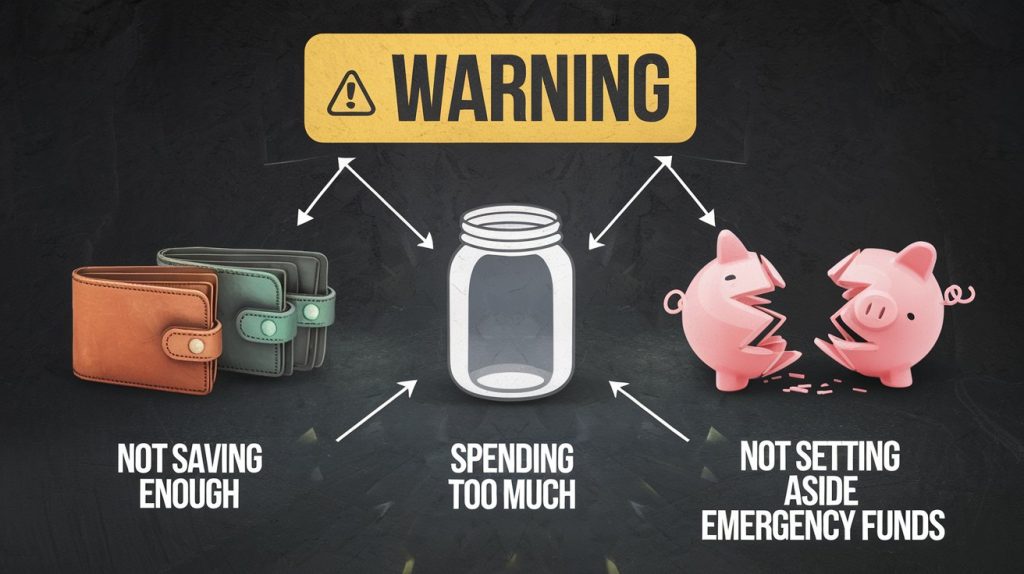

Common Budgeting Mistakes to Avoid

Even with the best intentions, budgeting mistakes happen. Here are some common ones and how to avoid them:

1. Underestimating Expenses

It’s easy to forget about occasional expenses like car maintenance or yearly subscriptions. Be sure to account for these by setting aside a small amount each month.

2. Not Having an Emergency Fund

An emergency fund is essential for covering unexpected expenses like medical bills or car repairs. Aim to save three to six months’ worth of living expenses.

3. Being Too Strict

Budgets that are too rigid are likely to fail. Give yourself some flexibility for discretionary spending so you don’t feel deprived and tempted to abandon your budget.

4. Forgetting to Adjust Your Budget

If your income increases or decreases, make sure your budget reflects that change. The same goes for life changes like moving to a new city or starting a family.

Conclusion

Budgeting is an ongoing process of planning, monitoring, and adjusting how you use your money. Whether you’re new to budgeting or looking to refine your current plan, the key is to find a system that works for your unique lifestyle and financial goals. With the right approach, you’ll not only gain control over your money but also make it work harder for you—setting the foundation for a financially secure future.

You can also read 10 Proven Marketing Strategies for Small Businesses.