Introduction

Importance of Financial Planning

Financial planning is the backbone of a secure future. Many individuals might feel overwhelmed at the thought of managing their finances, but a solid plan can provide clarity and confidence. Imagine waking up each day knowing exactly where your money is going and how it’s growing. A well-structured financial plan empowers you to make informed decisions, paving the way toward achieving your dreams.

Setting Financial Goals

Setting clear financial goals is essential for achieving long-term success. Not only does this approach give your spending direction, but it also helps in prioritizing what’s important. Here are a few examples of financial goals you might consider:

- Short-term goals (1-3 years): Saving for a vacation or paying off credit card debt.

- Medium-term goals (3-5 years): Building an emergency fund or saving for a car.

- Long-term goals (5+ years): Purchasing a home or funding your retirement.

By defining these goals, you can track your progress and adapt your strategies as needed, making financial planning not just a necessity but a fulfilling journey toward a stable future.

Financial Strategies in Your 20s

Budgeting Techniques

In your 20s, establishing effective budgeting techniques can set the foundation for future financial stability. It might feel a bit tedious at first, but this discipline pays off. One popular approach is the 50/30/20 rule:

- 50% for needs (rent, utilities, groceries)

- 30% for wants (dining out, entertainment)

- 20% for savings and debt repayment

Using budgeting apps can also help visualize your financial situation easily, keeping your spending in check while you strive for those goals you set earlier.

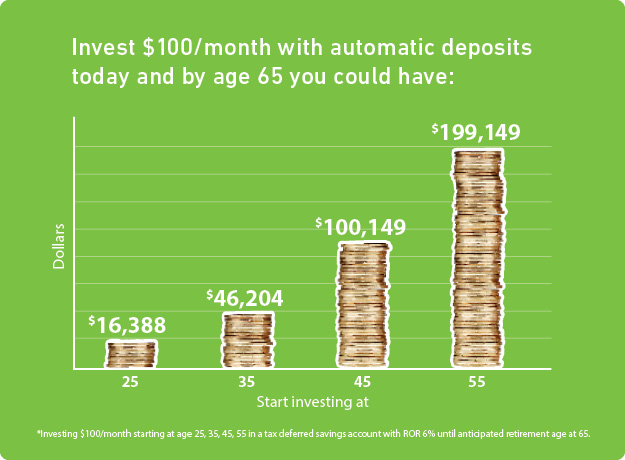

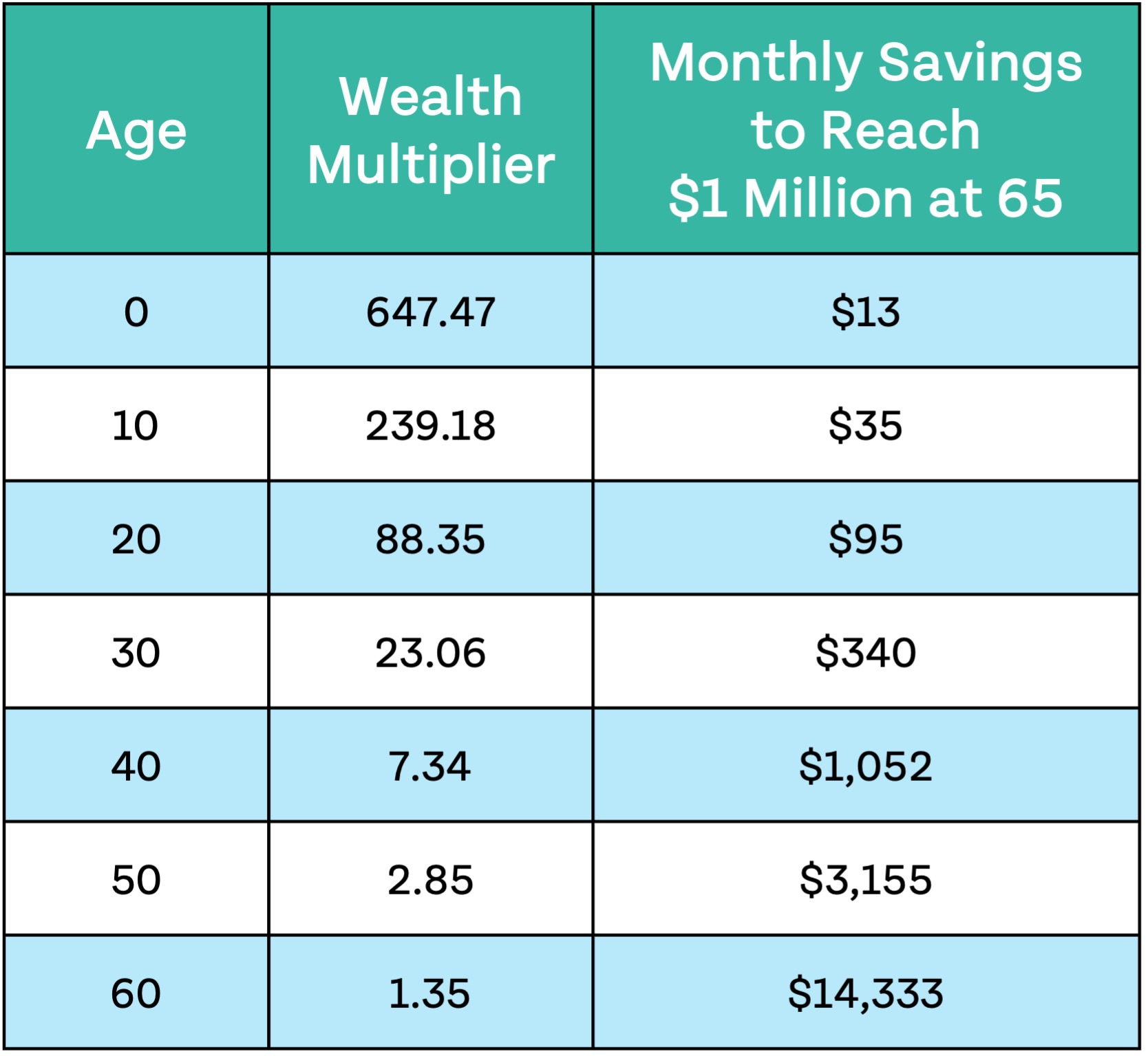

Investing for the Future

Investing early can significantly benefit you in the long run due to the power of compound interest. Even small amounts matter! Consider starting with:

- Retirement accounts like a Roth IRA: It allows your money to grow tax-free.

- Index funds or ETFs: They provide broad market exposure with lower fees.

A personal anecdote: Many young investors find success by setting aside just a few dollars each week. Over time, this can accumulate into a substantial nest egg. Embracing investment strategies now will prepare you for financial growth and security down the road.

Building Wealth in Your 30s

Real Estate Investments

As you enter your 30s, building wealth often becomes a top priority, and real estate investments can be a significant avenue for growth. Many find success by purchasing rental properties to generate passive income. Here are a few tips to consider:

- Research the market: Understand local property values and rental rates.

- Start small: A single-family home or a duplex can be a good entry point.

- Consider REITs: Real Estate Investment Trusts allow you to invest in real estate without owning physical properties.

A friend of mine bought a small condo in her late 30s and has enjoyed steady rental income since. This strategy not only builds wealth but also provides financial security.

Managing Debt

While building wealth, managing debt is equally crucial. Balancing student loans, credit cards, and a mortgage can be daunting. However, effective debt management can free up more funds for investing. Consider these strategies:

- Create a debt repayment plan: Focus on high-interest debts first, employing strategies like the snowball method.

- Limit new debt: Cultivate a lifestyle within your means to avoid adding to existing debts.

- Monitor your credit: Good credit can lead to better interest rates on loans that can further facilitate investment opportunities.

By effectively juggling real estate investments and managing debt, individuals in their 30s can establish a strong financial foundation for the future.

Looking Ahead to Retirement

Retirement Savings Accounts

As you progress in your career and personal life, it’s essential to shift focus toward retirement. Retirement savings accounts are a powerful way to ensure that you can enjoy your golden years without financial strain. Consider the following options:

- 401(k): If your employer offers a matching contribution, take full advantage—it’s essentially free money!

- IRA (Individual Retirement Account): A traditional IRA provides tax-deferred growth, while a Roth IRA allows for tax-free withdrawals in retirement.

A co-worker of mine started contributing to a 401(k) early on, and after a decade, it became a sizeable nest egg for retirement.

Creating a Retirement Income Plan

After establishing savings, it’s crucial to create a retirement income plan to ensure those funds last. Here are some strategies to consider:

- Estimate your expenses: Calculate your monthly expenses in retirement to establish how much income you’ll need.

- Diversify income sources: Consider a mix of Social Security, pension, investment income, and savings withdrawals.

- Maintain flexibility: Regularly review and adjust your plan to accommodate lifestyle changes and economic factors.

Developing a comprehensive retirement income strategy can help reduce the stress of financial uncertainty, allowing for a more enjoyable and relaxed retirement experience.

Beyond Your 40s

Estate Planning

As individuals move beyond their 40s, financial responsibilities often shift towards ensuring that their loved ones are protected through estate planning. It might feel overwhelming, but it’s crucial to have a clear plan. Consider these elements:

- Wills: Outline how you want your assets distributed.

- Trusts: Establish a trust to manage your assets and possibly reduce taxes.

- Health care directives: Make preferences known regarding medical decisions.

A colleague of mine set up a family trust to safeguard his children’s inheritance, creating peace of mind knowing they’d be cared for in his absence.

Additional Income Streams

In this stage of life, exploring additional income streams can further bolster financial security. Diversifying income is key. Here are a few options to consider:

- Side businesses: Turn hobbies into income-generating ventures, such as freelancing or consulting.

- Passive income: Invest in dividend-paying stocks or create online courses.

- Rental properties: If you have real estate, consider short-term rentals for supplemental income.

By engaging in estate planning and exploring multiple income streams, individuals can create a robust financial strategy, ensuring stability for themselves and their families as they continue to build wealth into their later years.

You can also read Smart Money Moves: Insider Secrets for Growing Your Wealth.