Introduction

Growing your wealth may seem like a distant goal, but with the right strategies and insights, it’s entirely achievable. In this guide, we dive into insider secrets and smart money moves that can help you make informed financial decisions and set you on the path to financial freedom. Whether you’re just starting or looking to refine your approach, these strategies are designed to put you in control of your financial future.

1. Start with a Clear Financial Plan

Creating a financial plan is the first essential step in growing wealth. A solid plan helps you set achievable goals, track progress, and stay focused even when challenges arise.

Key Steps:

- Assess Your Current Financial Status: Evaluate your assets, debts, income, and spending patterns.

- Set SMART Financial Goals: SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, aim to save $10,000 for an emergency fund within a year.

- Budget with Purpose: Allocate your income towards savings, essentials, debt, and investments.

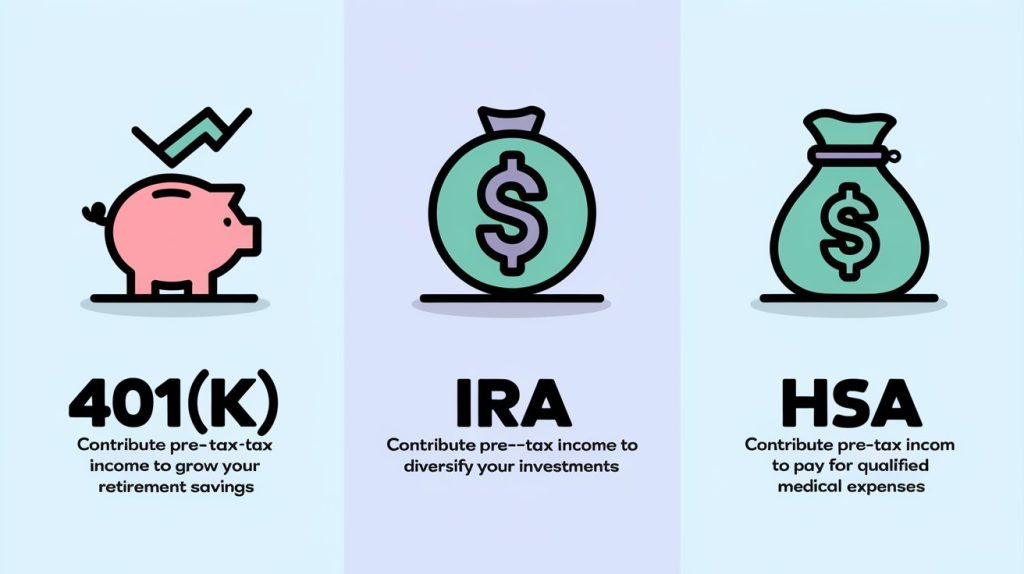

2. Make the Most of Tax-Advantaged Accounts

Tax-advantaged accounts, like 401(k)s, IRAs, and Health Savings Accounts (HSAs), offer powerful benefits that can help you grow wealth faster by reducing your taxable income.

Maximizing Tax Benefits:

- 401(k) Matching: Contribute enough to take advantage of employer matching. It’s essentially free money for your retirement.

- Health Savings Accounts (HSAs): These accounts allow tax-free contributions, growth, and withdrawals for medical expenses.

- Roth IRA: Contributions are taxed upfront, but withdrawals in retirement are tax-free, making it an excellent choice for long-term savings.

3. Prioritize Debt Management

Paying off high-interest debt should be a top priority. High-interest loans, especially credit cards, can eat away at your wealth-building potential.

Debt Reduction Techniques:

- Snowball Method: Focus on paying off the smallest debts first to gain momentum.

- Avalanche Method: Start with the highest-interest debts, reducing the overall interest you pay.

- Debt Consolidation: Consider consolidating loans if it lowers your interest rate and simplifies your payments.

4. Automate Your Savings and Investments

Automating your savings and investments makes it easier to stay on track with your financial goals. Many online banks and brokerages offer automated transfers, helping you save consistently without needing to think about it.

Automation Tips:

- Direct Deposit for Savings: Set up direct deposits to automatically send a percentage of each paycheck into your savings account.

- Automatic Investments: Many brokers allow you to automate investments into mutual funds, ETFs, or individual stocks.

- Emergency Fund First: Automate contributions to an emergency fund until you have 3-6 months’ worth of expenses covered.

5. Invest in Assets that Appreciate

Investing in assets like stocks, real estate, or even specific collectibles can help build wealth over time. The goal is to focus on assets that will increase in value or provide passive income.

Key Areas to Consider:

- Real Estate: Investing in property can provide rental income and appreciate over time.

- Stocks and Bonds: Diversify between growth stocks and income-generating bonds to balance risk and return.

- Alternative Investments: Art, collectibles, or even some cryptocurrencies can diversify your portfolio but should be approached cautiously.

6. Diversify Your Investment Portfolio

Diversification is a key principle for managing risk. A well-diversified portfolio reduces the impact of poor performance in any single investment.

Diversification Tips:

- Invest Across Asset Classes: Include a mix of stocks, bonds, and other assets.

- Geographic Diversification: Invest in both domestic and international markets to spread risk.

- Rebalance Regularly: Periodically review and adjust your portfolio to maintain your desired asset allocation.

7. Continually Educate Yourself on Financial Literacy

Financial literacy is a powerful tool. The more you know, the better equipped you’ll be to make informed financial decisions.

Resources for Financial Literacy:

- Books: Consider reading classics like Rich Dad Poor Dad and The Intelligent Investor.

- Courses and Workshops: Many online platforms offer courses on personal finance and investing.

- Financial Podcasts and Blogs: Stay updated with financial trends and insights from trusted sources.

8. Focus on Long-Term Goals Over Short-Term Gains

It’s tempting to chase quick profits, but sustainable wealth comes from focusing on long-term goals. Avoid high-risk “get-rich-quick” schemes and instead build wealth with patience and discipline.

Strategies for Long-Term Focus:

- Regularly Review Your Financial Plan: Ensure it aligns with your evolving goals and life changes.

- Avoid Emotional Investing: Make investment decisions based on strategy, not emotions.

- Compound Interest: Let your investments grow over time, leveraging the power of compound interest.

Conclusion

Growing your wealth requires discipline, knowledge, and a proactive approach. By implementing these smart money moves, you’ll be equipped to navigate the complexities of personal finance and make strides toward financial independence. Remember, wealth-building is a journey, so stay consistent and keep learning.

By following these strategies and committing to ongoing financial education, you can take control of your finances and work toward true financial independence.

You can also read How to Grow Your YouTube Channel from 0 to 1,000 Subscribers in 14 Days