Compound interest is often hailed as one of the most powerful forces in finance, and for good reason. It’s a tool that has the potential to grow your wealth exponentially over time, transforming small savings into a sizable nest egg. Whether you’re saving for retirement, a major life event, or just trying to build your financial security, understanding how compound interest works and how to harness it is key. In this article, we will dive deep into what compound interest is, why it matters, and how you can use it to your advantage.

What is Compound Interest?

At its core, compound interest is interest earned on both the initial principal (the amount of money you originally invested or saved) and the interest that has already been added to that principal. This “interest on interest” effect allows your money to grow at a faster rate compared to simple interest, where interest is only calculated on the original principal.

Here’s an example to illustrate the difference:

- Simple Interest: If you invest $1,000 at a 5% simple interest rate for 10 years, you’ll earn $500 in interest over that period, resulting in a total of $1,500.

- Compound Interest: With compound interest, the interest is calculated on both the principal and the accrued interest. Over 10 years, that same $1,000 investment at a 5% annual compound interest rate would grow to around $1,628 — an additional $128 without any extra effort!

How Compound Interest Works

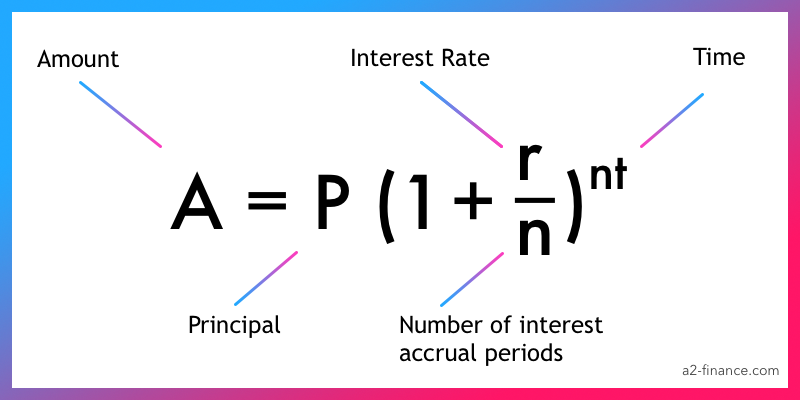

Compound interest is calculated using the following formula:

Where:

- A = the amount of money accumulated after interest (including interest)

- P = the principal amount (the initial investment)

- r = the annual interest rate (as a decimal)

- n = the number of times interest is compounded per year

- t = the number of years the money is invested for

Factors That Affect Compound Interest

- Principal (P): The more you invest initially, the more interest you’ll earn over time.

- Rate (r): The higher the interest rate, the greater your returns.

- Time (t): Time is your best friend when it comes to compound interest. The longer your money is invested, the more it grows.

- Compounding Frequency (n): Interest can be compounded annually, semi-annually, quarterly, or even daily. The more frequently interest is compounded, the faster your investment grows.

The Magic of Time: Starting Early Pays Off

One of the most crucial factors in the success of compound interest is time. The earlier you start investing, the more time your money has to grow. Let’s look at two hypothetical scenarios:

- Investor A starts saving $200 a month at the age of 25, with an interest rate of 6% compounded annually.

- Investor B starts saving the same amount but waits until they are 35.

By the age of 65, Investor A will have accumulated roughly $465,000, while Investor B will have around $245,000 — a difference of over $200,000, even though Investor A only contributed $24,000 more in principal. That’s the power of compound interest combined with time.

Maximizing the Benefits of Compound Interest

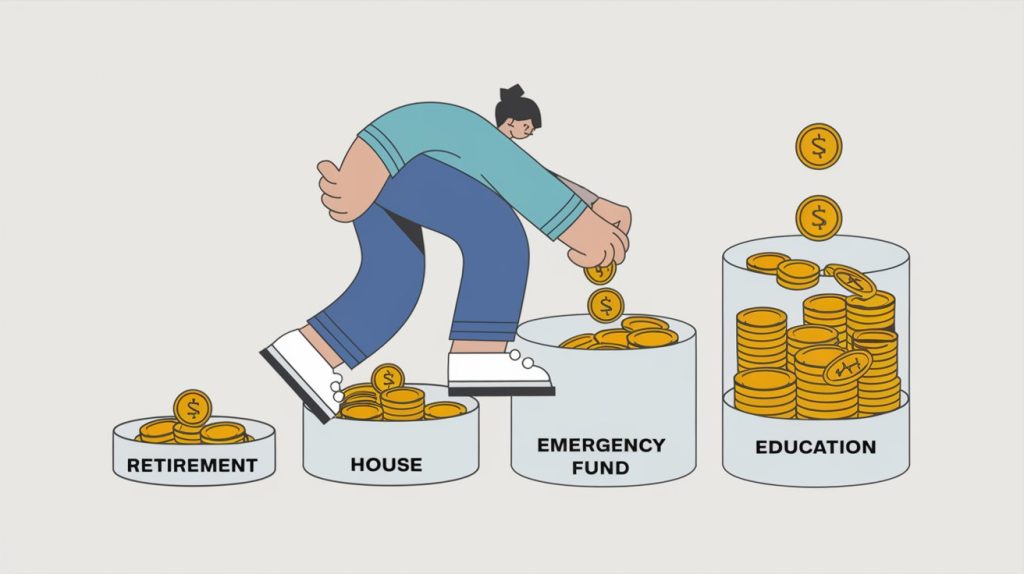

To fully take advantage of compound interest, consider these strategies:

- Start Early: The sooner you start saving or investing, the more time compound interest has to work in your favor.

- Contribute Regularly: Even small, regular contributions can lead to significant growth over time.

- Reinvest Your Earnings: Ensure that any dividends or interest earned are reinvested to benefit from further compounding.

- Increase Your Contributions Over Time: As your income increases, try to boost the amount you’re saving or investing.

- Focus on Long-Term Investments: Compound interest is most effective over long periods, so focus on strategies like retirement accounts, index funds, or high-yield savings accounts that encourage long-term growth.

The Importance of Consistency and Patience

Compound interest isn’t a get-rich-quick scheme. It requires patience and discipline. But if you stay consistent with your contributions, resist the temptation to withdraw early, and give your investments enough time to grow, the rewards can be significant.

One thing to remember is that compound interest works both ways. If you have debt that accrues interest, such as credit cards or loans, compound interest can also work against you. The longer you carry a balance, the more interest you’ll owe. This is why it’s crucial to manage debt wisely and pay off high-interest loans as quickly as possible.

Conclusion: The True Power of Compound Interest

Compound interest is a simple yet incredibly powerful financial tool that can help you grow your wealth over time. Whether you’re just starting your financial journey or looking to maximize your current investments, understanding and applying the principles of compound interest can lead to long-term financial security. Remember, the key to unlocking the magic of compound interest is time. Start as early as possible, stay consistent, and watch your wealth grow.

You can also read Credit Cards 101: How to Use Them Wisely and Avoid Debt.