Introduction

Many people believe that you need to have a lot of money to start investing. However, this misconception often keeps beginners from tapping into the power of investing. The truth is, you can start investing with just a small amount of money, and over time, that money can grow. This guide is designed for beginners who want to dip their toes into the world of investing, even if they don’t have much to start with.

1. Why Should You Start Investing Early?

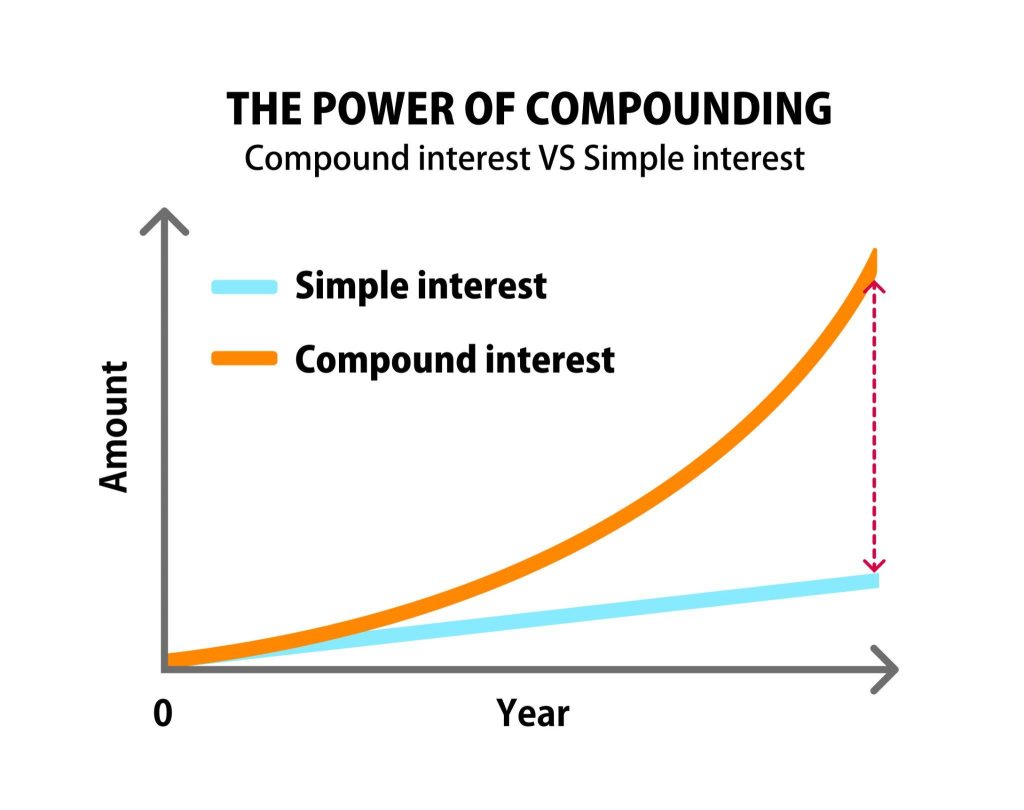

One of the most powerful reasons to start investing, even with little money, is the magic of compound interest. This is where the money you invest earns returns, and then those returns also begin to earn returns. The earlier you start, the more time your money has to grow. Waiting to accumulate a larger sum can delay this growth.

Starting early also allows you to develop good financial habits and become comfortable with the concept of risk versus reward. Even small investments can help you understand how the market works.

2. How Much Money Do You Need to Start?

The idea that you need thousands of dollars to start investing is outdated. Thanks to modern financial technologies, you can start investing with as little as $5. Here’s how:

- Micro-investing apps: Apps like Acorns, Stash, and Robinhood let you invest tiny amounts of money, even spare change.

- Fractional shares: You don’t need to buy an entire share of an expensive stock like Amazon or Tesla. Many platforms offer fractional shares, meaning you can invest as little as a few dollars.

- No minimum mutual funds: Some mutual funds or ETFs (Exchange-Traded Funds) have low or no minimum requirements, which allows you to diversify even with small amounts.

3. What Investment Options Are Available for Beginners?

When you have limited funds, it’s crucial to choose investments that are both low-cost and provide room for growth. Here are some great options:

- Index Funds and ETFs: These are collections of stocks or bonds bundled together. They offer instant diversification and typically have low fees. A popular example is the S&P 500 index fund, which includes 500 of the largest U.S. companies.

- Robo-Advisors: These are automated platforms that manage your investments for you, based on your risk tolerance and goals. Services like Betterment and Wealthfront offer low-fee options that require little to no money upfront.

- Stocks: Individual stocks represent ownership in a company. While they can be volatile, you can buy fractional shares in companies you believe will grow over time. Start with well-established companies, or consider blue-chip stocks that offer dividends.

- Cryptocurrency: If you’re interested in more speculative investing, cryptocurrency could be an option, but it’s very risky. Consider starting with a small amount to understand the market before going deeper.

4. The Importance of Diversification

Diversification is a key principle of investing that protects you from significant losses. Rather than putting all your money into one stock or asset class, spreading your investments across different types of assets (like stocks, bonds, and real estate) reduces risk. This way, if one investment performs poorly, others may balance it out.

For example, a well-diversified portfolio might include:

- 50% in stocks (a mix of tech, healthcare, consumer goods)

- 30% in bonds (safer, less volatile investments)

- 10% in real estate (perhaps through a real estate ETF)

- 10% in alternative investments like cryptocurrency or commodities

5. Start with a Budget and Automate Your Investments

If you’re starting with little money, one of the best strategies is to make investing a part of your budget. Determine an amount you can set aside regularly, even if it’s just $25 a month. The consistency of investing is more important than the amount.

Many investment platforms allow you to automate contributions. You can set up automatic transfers from your bank account into your investment account. This method takes the emotion out of investing, ensuring you keep investing regardless of market fluctuations.

6. What to Watch Out For as a Beginner

As a beginner investor, there are a few common pitfalls to avoid:

- High Fees: Some mutual funds and advisors charge high fees, which can eat into your returns. Always look for low-cost options.

- Trying to Time the Market: This involves buying and selling based on market conditions. Timing the market is nearly impossible, even for experts. Instead, adopt a long-term strategy and remain consistent.

- Overleveraging: Avoid borrowing money to invest (leverage), as this can amplify both gains and losses. When you’re just starting, it’s better to invest only what you can afford to lose.

- Emotional Investing: Markets go up and down. Don’t panic-sell when the market dips, as it can often rebound. Sticking to a plan can be more beneficial than making decisions based on emotions.

7. Final Thoughts: The Journey of Building Wealth

Starting with little money may seem daunting, but with patience, knowledge, and the right tools, you can grow your wealth over time. The key is consistency—set aside what you can and let time and compound interest do their work. As you gain confidence, you can explore more advanced investment strategies and diversify further.

Remember, every successful investor started somewhere. By taking small steps today, you’re building a brighter financial future for yourself.

This comprehensive guide offers step-by-step advice for beginners who want to start investing with little money. By focusing on practical tips, modern tools, and simple strategies, this article empowers readers to take control of their financial future, even if they’re starting small.

You can as well check out my article The Power of Compound Interest: Grow Your Wealth Over Time.