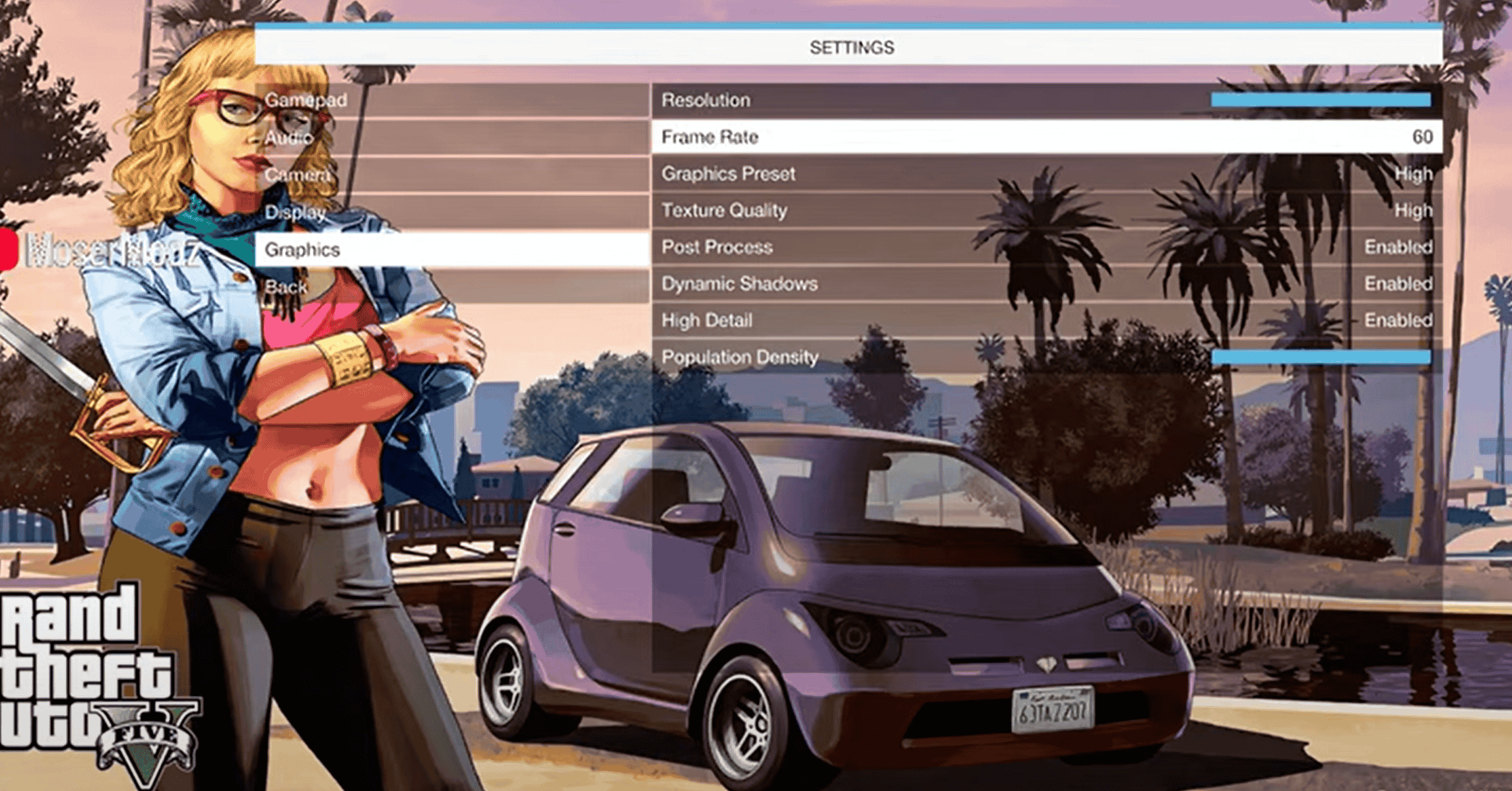

GTA 5 APK San Andreas Edition Mod: Fan made Edition

Rockstar Games’ Grand Theft Auto (GTA) series holds a legendary status in gaming, captivating millions globally with its immersive open worlds, compelling narratives, and thrilling action. The immense popularity of titles like GTA V and GTA: San Andreas has, however, given rise to a unique phenomenon: the widespread interest in fan-made modifications and unofficial releases, particularly those dubbed “GTA 5 APK San Andreas Edition Mod.” This article aims to clarify what these fan creations are, distinguish them from official products, and highlight the important considerations for those seeking them out.GTA 5 APK San Andreas Edition Mod: Fan made Edition