Understanding Financial Wellness

Defining Financial Wellness

Financial wellness is not just about having a bank full of cash; it’s a holistic approach to your financial health that signifies having a sense of security regarding both your present and future financial situation. It encompasses budgeting effectively, minimizing debts, and investing wisely for long-term growth. Key components of financial wellness include:

- Budgeting: Knowing where your money goes.

- Debt Management: Reducing high-interest debt to alleviate financial stress.

- Savings: Building an emergency fund to weather unexpected expenses.

- Investing: Making informed decisions that support future financial wellness.

Significance of Financial Wellness

Achieving financial wellness can lead to reduced stress and greater peace of mind. It creates a stable foundation for individuals to pursue their dreams, such as homeownership or retirement. Financial wellness is essential because:

- It empowers informed financial decisions.

- Enhances overall quality of life.

- Allows for better planning for emergencies or retirement.

- Strengthens emotional well-being and confidence in managing finances.

For instance, someone who maintains a solid budget and savings is less likely to panic during an economic downturn compared to someone overwhelmed by debt and uncertainty. Ultimately, financial wellness serves as a roadmap for individuals to achieve their financial goals while fostering a sense of stability and control.

Evaluating Your Current Financial Situation

Assessing Income and Expenses

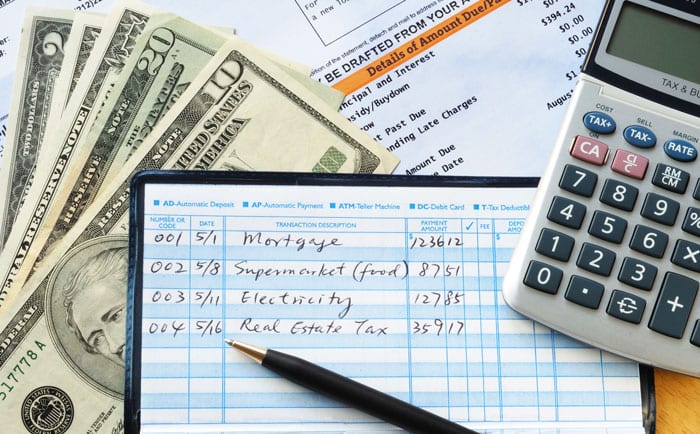

To achieve financial wellness, it’s essential to have a clear understanding of your income and expenses. Start by tracking your sources of income, which may include your salary, side hustles, and any passive income streams. Then, list your expenses, categorizing them into fixed, variable, and irregular costs:

- Fixed Expenses: Rent, mortgage, utilities, insurance.

- Variable Expenses: Groceries, clothing, entertainment.

- Irregular Expenses: Medical bills, home repairs.

This breakdown will not only help you see where your money is going but also pinpoint areas for potential savings.

Reviewing Debt and Savings

Next, take a close look at your debts and savings. List all your debts, focusing on high-interest obligations like credit cards or personal loans. Consider the following strategies for managing debt:

- Minimum Payments: Always make at least the minimum payments.

- Prioritization: Focus on high-interest debts first to minimize interest charges.

On the savings front, evaluate your emergency fund and retirement accounts. Ask yourself:

- Do I have at least three to six months of living expenses saved?

- Am I contributing enough to my retirement accounts to benefit from employer matching?

Taking the time to assess both your debts and your savings will provide clarity, helping you make informed decisions moving forward.

Creating a Realistic Budget

Setting Financial Goals

Creating a realistic budget begins with establishing clear financial goals. Determine what you want to achieve, whether it’s building an emergency fund, saving for a vacation, or paying off debt. Setting specific targets can make budgeting feel more purposeful. Examples include:

- Short-Term Goals: Save $1,000 for emergencies in the next 6 months.

- Long-Term Goals: Save for a down payment on a home within 3 years.

These goals will guide your budgeting process, providing motivation and direction.

Tracking and Managing Expenses

Once your goals are set, it’s time to track and manage your expenses effectively. Start by documenting all your spending:

- Categories: Break expenses into fixed (housing, insurance) and variable (entertainment, groceries) costs.

- Tools: Use apps or spreadsheets for easy tracking.

- Review Statements: Check bank and credit card statements monthly to identify spending patterns.

Consider implementing these strategies:

- Automate Savings: Set up automatic transfers to your savings account to ensure you pay yourself first.

- Monthly Reviews: Take time each month to review your budget, assess your progress toward your financial goals, and adjust as necessary.

By actively managing your budget, individuals can maintain control over their finances while steadily working towards their financial aspirations.

Minimizing Unnecessary Expenses

Cutting Subscription Services

One effective way to minimize unnecessary expenses is by evaluating your subscription services. Many people forget about ongoing charges for streaming, magazines, and apps. Here’s how you can streamline:

- List Your Subscriptions: Write down all recurring subscriptions.

- Assess Usage: Ask yourself how often you use each one.

- Cancel Unused Services: If it’s not providing value, cut it!

By cutting just a couple of subscriptions, you can find extra cash each month that can be redirected to savings or essential expenses.

Reducing Dining Out Costs

Dining out can significantly dent your budget. If you frequently grab takeout or eat at restaurants, you might be surprised at how much that adds up. Here are some strategies:

- Meal Prep: Prepare meals for the week to reduce impulse dining.

- Pack Lunch: Bring homemade lunches to work or outings.

- Limit Dining Out: Set a monthly limit on how often you dine out.

For instance, swapping just one restaurant meal a week for a home-cooked meal can save you $200 a month! Small changes can collectively lead to more substantial savings and promote better financial health.

Increasing Income Streams

Exploring Side Hustle Opportunities

If you’re looking to boost your financial wellness, exploring side hustle opportunities can be an effective way to increase your income. Many individuals find success in areas such as:

- Freelancing: Utilize your skills in writing, graphic design, or programming.

- Online Tutoring: Teach subjects you excel in through online platforms.

- Selling Crafts or Products: Create and sell handmade items or drop-ship products through e-commerce sites.

For instance, a friend of mine turned her love for crafting into a profitable Etsy shop, generating extra income each month. Finding something you enjoy can make the process more fulfilling.

Negotiating a Salary Raise

Another way to increase your income is to negotiate a salary raise at your current job. Here’s how to prepare:

- Research Market Rates: Understand what others in your position earn in your area.

- Build Your Case: Keep a record of your accomplishments and contributions to the company.

- Practice Your Pitch: Rehearse what you’ll say during the conversation to gain confidence.

For example, when I approached my manager with a comprehensive list of my contributions over the past year, I successfully secured a raise. Preparing in advance can significantly impact the outcome of your negotiation.

Incorporating these strategies into your financial plan can significantly improve your financial situation, allowing you to save more towards both short- and long-term goals.

Building an Emergency Fund

Importance of an Emergency Fund

Having an emergency fund is essential for financial stability. It acts as a financial safety net during unforeseen circumstances, such as medical emergencies, car repairs, or job loss. Without this fund, even minor expenses can lead to significant debt, putting your long-term financial health at risk.

- Provides Peace of Mind: Knowing you have funds available can reduce stress during unexpected situations.

- Avoids High-Interest Debt: Instead of relying on credit cards, you can cover emergencies without accruing debt.

For instance, when my friend faced an unexpected medical bill, her emergency fund allowed her to pay it off immediately, preventing her from turning to high-interest credit options.

Tips for Saving for Emergencies

Building an emergency fund takes time and discipline, but it’s achievable with the right approach. Here are some effective strategies:

- Set a Savings Goal: Aim for at least 3-6 months’ worth of living expenses.

- Open a High-Yield Savings Account: This allows your money to grow with interest while remaining accessible.

- Automate Savings: Set up automatic transfers from your checking account to your savings account.

- Cut Unnecessary Expenses: Review your budget and pinpoint areas for savings, like dining out or entertainment.

- Use Extra Income Wisely: Consider directing bonuses, tax refunds, or side hustle income towards your emergency fund.

By implementing these tips consistently, individuals can create and reinforce their emergency fund, providing crucial financial protection for the future.

Paying Off Debts Strategically

Prioritizing High-Interest Debts

When it comes to paying off debts, the first step is always to focus on high-interest debts, such as credit card balances. These can quickly accumulate interest, making it harder to pay off your principal amount. Consider these strategies:

- List Debts by Interest Rate: Identify which debts cost you the most each month.

- Consolidate if Possible: Look into consolidating high-interest debts into a lower-interest loan.

For example, after realizing that my credit card interest rates were as high as 24%, I focused on paying those down first to save money in the long run.

Utilizing Debt Repayment Strategies

Implementing effective repayment strategies can help you tackle your debt more efficiently. Two popular methods include:

- Snowball Method: Pay off your smallest debts first while making minimum payments on larger ones. Once a smaller debt is cleared, apply that payment toward the next smallest debt.

- Avalanche Method: Focus on paying off debts with the highest interest rates first, which saves you more money over time.

Both methods have their merits; choose based on what will keep you more motivated. Personally, I used the snowball method and was encouraged by knocking out smaller debts, which kept me on track.

By prioritizing high-interest debts and using effective repayment strategies, individuals can gradually eliminate their financial obligations and pave the way for a more stable financial future.

Investing Wisely for the Future

Understanding Investment Options

Investing is a crucial step in building wealth, and understanding the various investment options available can help you make informed decisions. Here are some common types of investments to consider:

- Stocks: Buying shares in companies can yield high returns but comes with greater risk.

- Bonds: These are considered safer investments, providing fixed interest over time.

- Mutual Funds: A collection of stocks and bonds managed by professionals, ideal for diversification.

- Real Estate: Investing in property can offer both rental income and appreciation in value.

For instance, after starting with a small stock investment, I gradually explored mutual funds and real estate, which helped me grow my portfolio.

Diversifying Your Investment Portfolio

Diversifying your investment portfolio is key to managing risk. By spreading your investments across different asset classes, you reduce the impact of poor performance in any single area. Here’s how to diversify:

- Use Asset Allocation: Allocate a specific percentage of your investments to stocks, bonds, and other assets based on your risk tolerance.

- Invest in Different Sectors: Consider various sectors, such as technology, healthcare, and finance, to reduce risks associated with market fluctuations.

- Include Alternative Investments: Explore options like commodities or index funds for added diversity.

By employing these strategies, you can safeguard your investments and potentially enhance returns across different market conditions. With a well-rounded investment strategy, you pave the way for long-term financial health and stability.

Planning for Retirement

Retirement Savings Accounts

When planning for retirement, it’s vital to consider various retirement savings accounts that can enhance your savings potential. Some popular options include:

- 401(k) Plans: Offered by employers, these allow for pre-tax contributions, reducing your taxable income.

- IRAs (Individual Retirement Accounts): There are two main types:

- Traditional IRA: Contributions may be tax-deductible, and investments grow tax-deferred until withdrawal.

- Roth IRA: Contributions are made after taxes, but withdrawals in retirement are tax-free.

For example, by consistently contributing to a 401(k) throughout my career, I’ve benefited significantly from employer matching, which accelerates my savings growth.

Seeking Professional Financial Advice

Navigating retirement planning can be complex, and seeking professional financial advice can provide much-needed clarity. A certified financial planner can help you:

- Assess Your Goals: Identify what kind of lifestyle you want during retirement.

- Create a Personalized Strategy: Develop a tailored approach to meet your financial needs and desires.

- Optimize Investments: Ensure your portfolio is balanced and aligned with your retirement timeline.

When I first approached a financial advisor, they helped me clarify my goals and adjusted my investment strategy to better prepare for the future.

By utilizing retirement accounts effectively and seeking expert advice, individuals can ensure they are on the right track to achieve a comfortable and secure retirement.

Monitoring and Adjusting Your Financial Plan

Regularly Reviewing Your Finances

To ensure your financial plan remains effective, regular reviews of your finances are essential. Taking the time to assess your budget, savings, investments, and overall financial health can help identify areas needing improvement. Consider:

- Monthly Check-Ins: Set aside time each month to go over your expenses and savings progress.

- Annual Reviews: At least once a year, evaluate your investments and adjust based on performance or changes in your life circumstances.

For instance, I conduct a monthly review and often discover ways to cut unnecessary expenses, keeping me on track toward my savings goals.

Making Necessary Changes for Financial Growth

As financial circumstances change, so should your plan. Here are steps to adapt effectively:

- Adjust Savings Goals: If you receive a raise, consider increasing your savings percentage.

- Reallocate Investments: If certain investments aren’t performing well, look into diversifying or shifting funds to higher-performing assets.

When I received a promotion, I decided to allocate a larger portion of my salary toward retirement savings, which significantly boosted my long-term financial growth.

By continually monitoring and adjusting your financial plan, individuals can position themselves for ongoing financial stability and growth, ensuring they meet their personal financial goals more effectively.