In today’s fast-paced world, achieving financial freedom and building wealth are dreams shared by many. What if I told you that it’s entirely possible to earn money while you sleep? Passive income, often referred to as the “holy grail” of financial independence, allows you to do just that. While it might take time, effort, and investment up front, the payoff is well worth it in the long run. In this blog post, I’ll share 10 proven ways to generate income even when you’re not actively working. These methods can help you unlock wealth and take steps toward financial independence.

1. Dividend-Paying Stocks

Investing in dividend-paying stocks is one of the simplest and most popular ways to earn passive income. When you own shares of companies that pay dividends, you’re entitled to a portion of the company’s profits. While the stock market can fluctuate, many well-established companies offer consistent dividend payments, providing you with regular income. Reinvesting dividends can also help compound your wealth over time.

2. Real Estate Investment Trusts (REITs)

Owning real estate is a classic way to build wealth, but not everyone has the time, knowledge, or capital to invest directly in property. REITs allow you to invest in real estate without owning physical property. These trusts pool investors’ money to buy, manage, and sell income-generating real estate like office buildings, apartments, and shopping centers. In return, REITs pay out dividends from the rent or sales profits.

3. Create and Sell Online Courses

If you have specialized knowledge or expertise in a certain field, consider creating an online course. Platforms like Udemy, Teachable, and Coursera make it easy to share your knowledge with the world. Once your course is live, you can generate passive income every time someone enrolls. The key to success here is creating a course on a topic with demand, ensuring it’s well-organized, and providing real value to your students.

4. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for every sale made through your referral link. The beauty of affiliate marketing is that it can be done through blogs, social media, or even YouTube channels. The initial setup requires time to build an audience, but once the system is in place, commissions can come in while you sleep. The key is choosing products or services that align with your niche and resonate with your audience.

5. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow you to lend money to individuals or businesses in exchange for interest payments. Websites like LendingClub or Prosper facilitate these loans, and as the borrower repays, you earn interest. While there’s a level of risk involved, with proper research, this can be a relatively passive way to earn income. Diversifying your investments across multiple loans can reduce the risk of default.

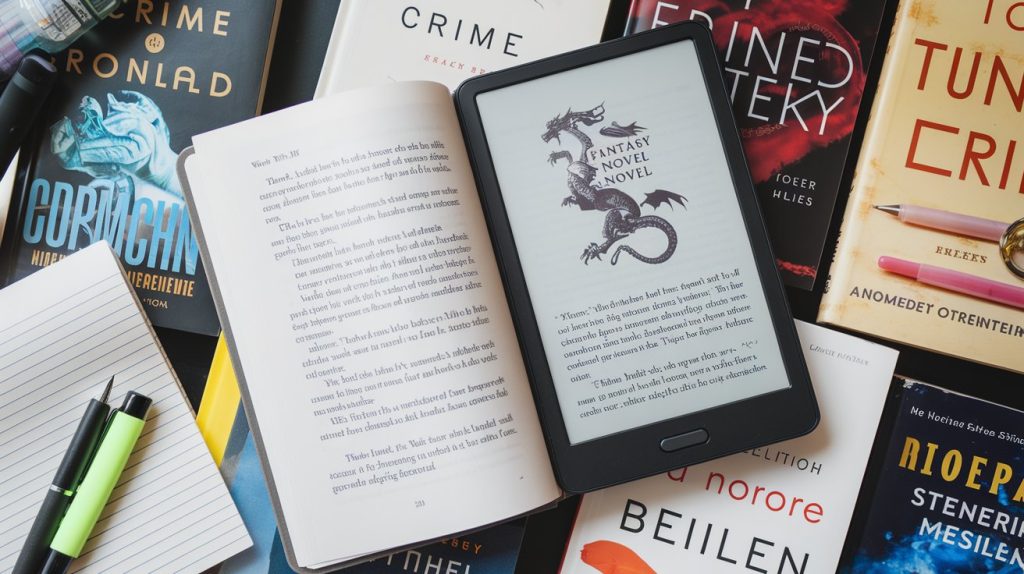

6. Write an E-Book

Do you have a knack for writing? If so, writing and publishing an e-book can generate passive income for years to come. Thanks to platforms like Amazon Kindle Direct Publishing (KDP), it’s easier than ever to self-publish. E-books require upfront work—writing, editing, and designing a cover—but once it’s uploaded and marketed, you can earn royalties from sales indefinitely.

7. Invest in a High-Yield Savings Account or CDs

While the returns are relatively low compared to other passive income methods, investing in high-yield savings accounts or certificates of deposit (CDs) can provide safe, steady returns. These accounts allow your money to grow over time with minimal risk, making them ideal for conservative investors. Some online banks offer better interest rates than traditional brick-and-mortar institutions, helping you maximize your passive earnings.

8. License Your Photography or Artwork

If you’re a photographer or artist, licensing your work through stock photo sites like Shutterstock, Adobe Stock, or iStock can be a great way to earn passive income. Every time someone downloads your image or uses your artwork for commercial purposes, you earn a royalty. Once your portfolio is up, it can generate a steady stream of income with little ongoing effort.

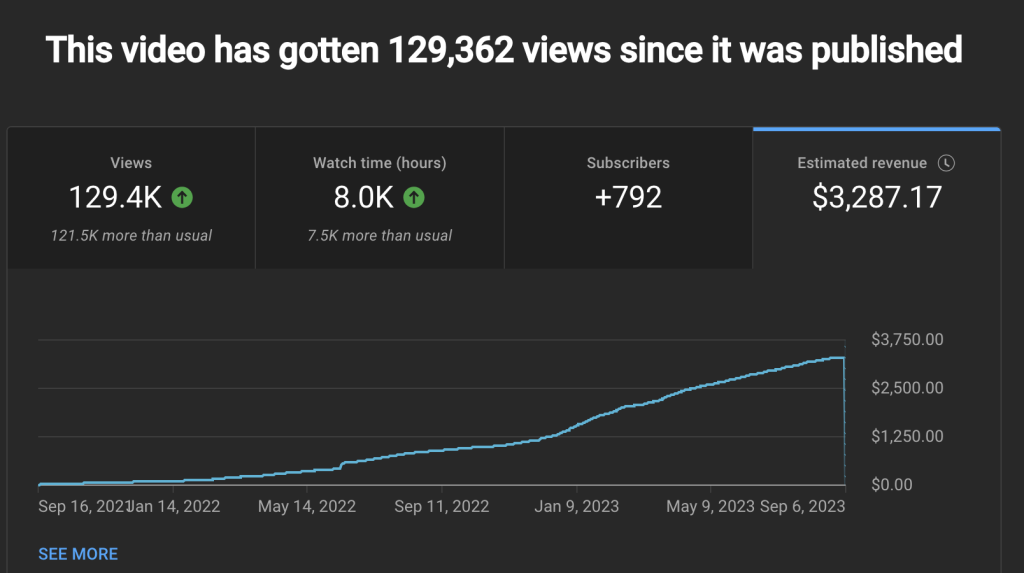

9. Start a YouTube Channel

YouTube offers a platform for creators to monetize their content through ads, sponsorships, and affiliate marketing. While it requires upfront effort to create engaging videos and build a following, once a video is published, it can generate income long after it’s been uploaded. Channels focused on evergreen content—topics that stay relevant over time—are especially successful in generating passive income.

10. Create a Mobile App or Software

If you have coding skills, creating a mobile app or software can be a powerful source of passive income. Once your app is developed and listed in app stores, you can earn revenue from ads, in-app purchases, or subscriptions. This method may require some updates and maintenance over time, but the income can continue to flow even after the app is launched.

Conclusion: Building Your Path to Wealth

Building passive income streams is a strategic way to secure your financial future. While most of these methods require an upfront investment of time, effort, or capital, the rewards can be substantial. Whether you start with something simple like dividend stocks or take a more creative route like writing an e-book or building an app, each of these options can help you unlock wealth and enjoy financial freedom. The key is to start today, keep learning, and remain consistent. Before you know it, you’ll be earning money even while you sleep.

You also read Building a Remote Business: Strategies for Success.